Microsoft, Nvidia, and OpenAI have two things in common: artificial intelligence (AI) and their dominant position in this technology. Recently, this disruption has propelled them to grow at full speed and further increase their size. U.S. regulators are starting to worry that this trio forms a monopoly in AI.

The U.S. Department of Justice (DOJ) and the Federal Trade Commission (FTC) are set to launch an investigation to determine the role these three companies play in the AI industry and whether they hold a monopoly, as reported by The New York Times and Financial Times. Both agencies have agreed to work together on this task, coordinating between them. The first will focus on Nvidia, and the second on Microsoft and OpenAI.

Regulators intend to move quickly before it’s too late. With the popularity of AI, they want to prevent these tech giants from further establishing themselves in the industry and gaining ground before they are forced to rectify and backtrack, if they are found to violate antitrust rules. Authorities have already begun examining their businesses. In recent months, two proceedings have been initiated, one on whether OpenAI has violated consumer rights by collecting their data and another reviewing the alliance between Microsoft and Sam Altman’s company.

Regulators are concerned that the market is becoming concentrated in three giant competitors. Microsoft is the world’s most valuable listed company, Nvidia became the second yesterday, surpassing Apple, and OpenAI is the largest private firm in its industry. And all three are putting a great deal of effort into continuing to grow in the AI market, which could make it difficult for smaller firms to enter into a business with great growth potential but already heavily dominated. Despite the vast potential for development in AI, the trio enjoys a significant advantage over any other competitor.

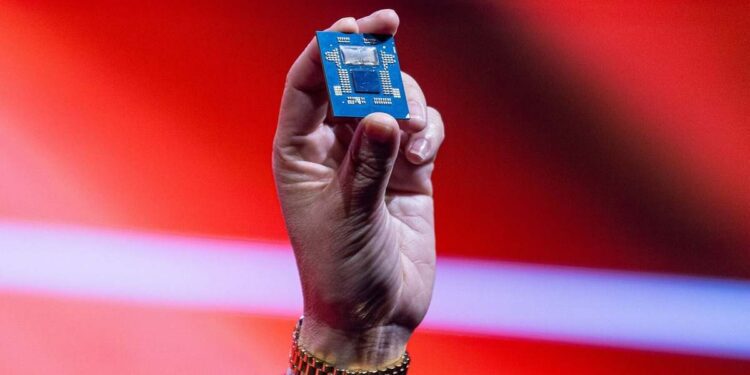

In the chip industry, regulators will focus on whether the graphics processing units for training AI language models have become a scarce resource, meaning solely in the hands of Nvidia. This could hinder U.S. government efforts to develop the processor industry through the incentives outlined in the Chip Act.

Furthermore, investigations will be carried out into Microsoft’s investments and whether they attempt to evade antitrust controls. The company owns 49% of OpenAI and has rights to its intellectual property. In addition, Satya Nadella’s company has hired the CEO of another AI firm, Inflection, along with 70% of the staff. While they have not entered the capital, this doesn’t mean the consequences on the company’s control remain the same.

Half of Microsoft’s investments are in AI

From 2022 to early this year, Microsoft has invested billions in AI startups. OpenAI is one of its 27 investments in this area, according to a study by S&P Global, which also details that the company’s venture capital arm, M12, is rapidly expanding its position in this sector.

In 2022, its investments in AI represented a quarter of the funds allocated to venture capital and in 2023, they accounted for almost half of all the money disbursed. It is clear where they want to become (even) stronger.

What could be the consequences of regulatory action?

Microsoft, Alphabet, or AT&T have previously been involved in high-profile cases of regulatory scrutiny. The company founded by Bill Gates controlled the PC market and regulators believed that, thanks to its dominance, it made it nearly impossible for other competitors’ software to be sold. In fact, its main rival, Netscape, eventually disappeared. The case lasted over a decade and it was decided that the tech giant would have to be split into two companies, a decision that was ultimately challenged and never came to pass.

The Microsoft case demonstrates two things: these processes can last many years – in this case, it lasted over a decade – and they threaten the continuity of a company as a whole. There are precedents, such as AT&T and Bell, where the company was forced to split. This does not only apply to the tech sector, as seen with the breakup of oil giant Standard Oil. Given the current state of affairs, it is difficult to predict whether this could be the fate of the three AI giants, as years of investigation and proceedings may lie ahead.

However, the impact that may result from these processes is increased innovation and patents in the industry when the actions of dominant firms are restricted, although this is not always the case. Additionally, authorities may require internet giants to take specific measures and restrict their dominance. For example, Google may not offer its browser by default and must give users the choice, or Apple may have to reduce its power over third-party apps in its app store.