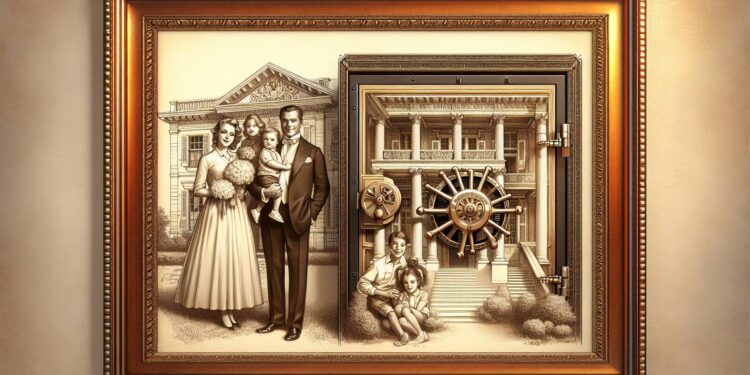

Recent revelations indicate that approximately 25% of affluent families do not disclose their financial wealth to their heirs. This lack of transparency can lead to potential future challenges, such as disputes among beneficiaries when assets are passed down.

It is crucial for wealthy individuals to have open discussions about financial matters with potential heirs to avoid unnecessary conflicts and complications. Seeking professional legal and financial advice can also help ensure a smooth transfer of assets. A structured approach to wealth distribution can prevent disputes and maintain family harmony.

Despite recognizing the importance of estate planning, 29% of these families have not yet educated and prepared their heirs for the financial inheritances that lie ahead. The secrecy surrounding wealth can result in misunderstandings and legal issues during wealth transfer. These households must start having frequent conversations about their estate plans with their successors. Families that engage in these discussions often report reduced family conflict, highlighting the significance of involving successors in the planning process.

According to a recent study involving U.S. single-family offices managing assets over $50 million, there is a trend of struggling to discuss wealth with the next generation.

Dealing with secrecy in family finances

The challenge lies in effectively communicating financial matters and wealth management to younger family members. There appears to be a pattern of reluctance around discussing family wealth. However, clear communication is vital to ensure smooth succession planning. Wealthier households tend to be more transparent about their finances, possibly due to having more resources and security, making financial transparency less risky.

There are several ways to tackle this issue, including instilling a philanthropic mindset and involving heirs in family businesses from an early age. Financial information should be gradually shared as children grow older, gradually involving them in minor investment decisions. Parents who are open about financial matters can instill a sense of financial responsibility in the younger generation.

Mentorship from family members or trusted advisors can also help provide a broader perspective on wealth management. Additionally, practical financial management lessons from a young age and encouraging young heirs to carve out their own paths can nurture independence and personal accomplishments.

Ultimately, disclosing family wealth early on helps young individuals grasp the value of money, setting the stage for financial stability in the future. It is generally recommended that full financial disclosure take place around the age of 25, though strategies and approaches may vary depending on individual family circumstances.