The term artificial intelligence (AI) is now closely tied to advancements in technology, particularly in customer service where its effects are markedly significant. Initially limited to straightforward automation, AI is now taking on more intricate roles within call centers, altering the dynamics of business-customer interactions and streamlining service workflows. Despite the potential of tools like chatbots to enhance service delivery, many organizations have faced a rather different scenario. Numerous AI integrations, especially chatbots, have not met expectations, leading to increased customer dissatisfaction instead of satisfaction.

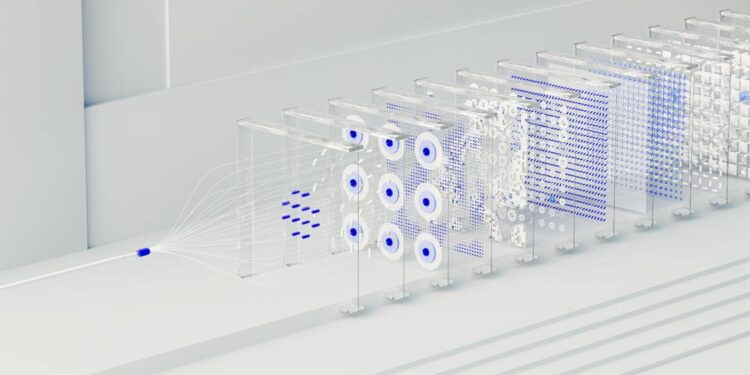

However, a new era of AI innovation is emerging, championed by companies like Operative Intelligence (OI). Rather than merely automating responses or directing inquiries, OI leverages advanced large language models (LLMs) to tackle some of the most persistent issues in customer service, such as discerning the reasons for customer outreach, foreseeing their needs, and translating that data into actionable insights that enhance service quality. This shift not only revitalizes call center operations but also establishes a framework on how AI can enhance the customer experience instead of detracting from it.

The Chatbot Dilemma: Why AI-Based Service Has Reached a Standstill

The realm of AI in customer service has been largely defined by chatbots, which claim to streamline experiences yet often miss their mark. A 2024 study by Worrklife Ventures revealed that 69% of consumers still favor speaking to human agents over chatbots. These AI-driven bots, frequently limited to basic question handling, tend to aggravate users seeking more refined support. They predominantly address the “what” of customer service—responding to inquiries and adhering to scripts—while neglecting the “why,” which pertains to the fundamental reasons customers reach out for assistance.

The consequence? An impaired customer experience. From financial institutions to airlines, various industries have deployed AI chatbots that often do not meet user expectations. Rather than boosting satisfaction levels, these bots tend to heighten frustrations, leading to more calls as customers ultimately seek human help. However, there is a more profound issue at hand: many of these AI implementations do not recognize systemic issues that could be addressed if identified promptly.

A recent incident involving a prominent unnamed U.S. bank exemplifies this issue. When a complication arose with two-factor authentication, the bank’s call centers and chatbots were inundated with calls. Although the chatbots functioned as intended by assisting users with login issues, there was no mechanism available to detect the underlying problem or escalate it for quick resolution. It was only when the issue persisted that engineering teams got involved, wasting valuable time and resources for the bank. This incident underscores a significant flaw in extant AI systems in customer service: they lack the capability to identify, comprehend, and react to core issues.

Introducing Operative Intelligence: An AI That Understands Customers

Operative Intelligence signifies a crucial pivot in the application of AI within customer service. Co-founded by brothers Peter and James Iansek, OI is built on their 25 years of dedication in call center operations. Distinct from conventional AI solutions that concentrate on automating particular tasks, OI strives to equip enterprises with the insights necessary to proactively address customer service hurdles.

“Fundamentally, customer service revolves around comprehending the customer. Unfortunately, companies have lacked the tools for this at scale for far too long,” asserts Peter Iansek, CEO of Operative Intelligence. “We created OI to not only pinpoint the immediate issues that customers are calling about but also to analyze and interpret the ‘why’ behind their inquiries.”

The OI platform runs seamlessly in the background of call centers, transcribing and capturing data from every call. Instead of merely summarizing conversations, it goes further by identifying trends, pinpointing systemic issues, and delivering actionable insights. For instance, if there is an influx of inquiries regarding a specific product, OI identifies this pattern, quantifies it, and proposes operational alterations to address the root cause.

This level of detailed intelligence marks a transformative development for call centers. Instead of relying on anecdotal evidence or labor-intensive manual examinations, organizations can now gain access to real-time insights concerning customer requirements and service obstacles.

Operative Intelligence boasts a diverse client base that includes some of the largest airlines, healthcare organizations, and service-oriented industries. One of its clients, Humm Group, a prominent financial services company in Australia, has experienced a significant improvement in customer interactions and operational performance since implementing OI’s solution in their customer support division.

Real-Time Insights for Practical Problems

A standout feature of OI is its capacity to provide real-time analytics. Conventional customer service metrics—like average handling time (AHT) or first call resolution (FCR)—only give a limited perspective of the dynamics occurring in a call center. They assess efficiency but not effectiveness. The OI platform revolutionizes this by providing companies with a comprehensive view of customer interactions.

Consider an airline struggling with a flood of refund applications due to a weather-induced cancellation. In a traditional call center environment, agents would address calls one by one, capturing some overall data but often overlooking specific insights. However, OI’s system meticulously monitors these discussions in real-time, highlighting particular concerns raised, predicting subsequent inquiries, and recommending solutions—such as automation for specific requests or targeted compensation strategies.

For extensive corporations in aviation, healthcare, and insurance that have embraced Operative Intelligence, the advantages are immediate. The platform enables more informed and rapid decision-making—whether it’s about minimizing customer attrition, enhancing agent performance, or identifying friction points that require attention. This capability is crucial in high-traffic sectors like airlines and banking, where even minor improvements in customer satisfaction can yield significant financial and operational gains.

A Multi-Billion Dollar Potential

The global customer service market encompasses a $100 billion opportunity, with call centers as its backbone. Despite considerable investments in customer service, numerous companies are still relying on antiquated systems that depend on ineffective processes and subpar technologies. OI’s offering seeks to transform this landscape by positioning itself as the “customer intelligence layer” that drives enterprise decision-making within contact centers.

“We aim to assist businesses in tapping into the potential of every customer interaction,” states James Iansek. “That’s something most existing AI solutions have struggled to achieve until now.”

The Coming Era of Customer Service

As AI continues to advance, customer service is set for a significant overhaul. While basic chatbots may persist in handling simple tasks, the true value will arise from AI systems capable of listening, learning, and acting on the multifaceted needs of consumers. Operative Intelligence is leading this transformation, providing a solution that enhances customer satisfaction while also facilitating broad business efficiencies.

For organizations grappling with the evolving demands of modern customer service, the directive is clear: the future hinges on not just automating the “what” but understanding the “why”—and Operative Intelligence is the key to realizing that future.