As per the latest data from TransUnion, Generation Z, aged 22 to 24, is facing a growing debt issue that is significantly larger than that of their predecessors.

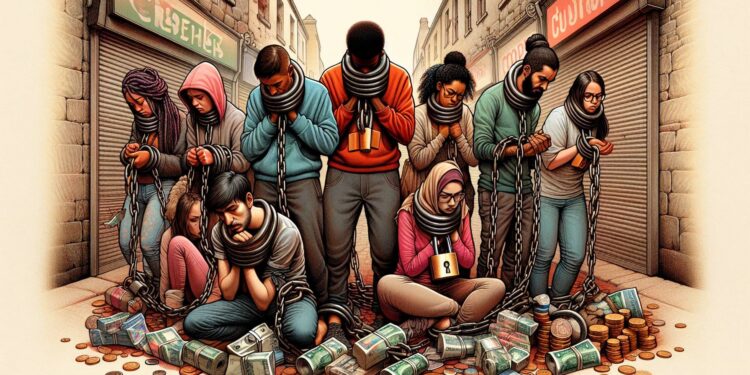

This surge in debt is in line with the increasing living expenses, especially in food and housing, exacerbated by the rise in student loans. This challenging situation is resulting in high default rates on credit cards.

As a result, more young individuals are relying on financial support from their families, delaying important life milestones like homeownership and marriage. According to Charlie Wise, the Global Research Head at TransUnion, the financial stress experienced by Gen Z exceeds that of millennials a decade ago.

Lindsay Quackenbush, a representative of Gen Z, exemplifies this financial burden. Losing her job led her to struggle with credit card debt, making minimum payments, and postponing personal life plans.

Approximately one-third of young Americans’ monthly incomes are going towards rent, driven by inflation. The median annual salary for recent 2023 U.S. graduates was $60,000.

Growing debt crisis among Generation Z

Scott Fulford, a senior economist at the Consumer Financial Protection Bureau, notes that while younger individuals typically have less wealth, high rental inflation further complicates the situation.

The Consumer Price Index for March 2024 shows that daily living expenses have increased by over 17% since March 2020. With expenses on the rise, young adults are increasingly turning to credit cards, surpassing the rate of older generations, as reported by The Journal.

This immediate solution leads to significant long-term debt with serious financial consequences. The additional uncertainty caused by the pandemic, such as unemployment, worsens the challenging financial circumstances for Generation Z.

To help address this issue, debt counseling services, like the Consumer Credit Counseling Service, are stepping up. These services provide young adults with guidance to navigate financial difficulties and make wise monetary decisions.

However, the future of Gen Z’s financial well-being remains uncertain unless there is systemic change involving favorable student loan terms and inflation control.

Some members of Generation Z have turned to financial literacy resources to alleviate some of these pressures, but a more comprehensive solution is needed. Topics like student loan forgiveness and increased minimum wages may spark controversy, but they are part of the ongoing discussion about preparing younger generations for their financial futures.