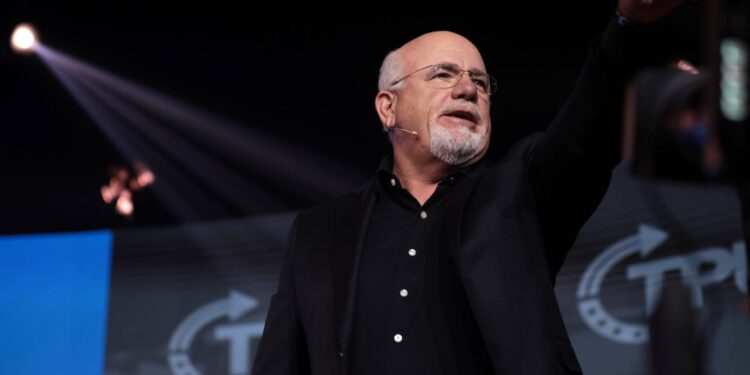

Dave Ramsey, a renowned expert in personal finance, has shared valuable insights regarding Medicare that may benefit retirees and individuals approaching retirement. Ramsey highlights that Medicare can be quite perplexing due to its governmental origins and the vast amount of information it entails. Generally, U.S. workers become eligible for Medicare upon reaching 65, though those with specific disabilities can register earlier.

Original Medicare consists of Parts A and B, which provide coverage for a variety of services, including physician visits and preventive care. Nonetheless, it does not encompass everything, with notable exclusions being long-term care, regular check-ups, and dentures. While enrollment in Medicare isn’t mandatory, most individuals choose to sign up at some point in their lives.

Typically, individuals with Part A are not required to pay a premium, although this may vary based on personal situations.

Comprehending Medicare eligibility and expenses

In 2024, the average monthly premium for individuals enrolled in Part B was $175.70. Both Part A and Part B come with annual deductibles.

Ramsey emphasizes that Medicare’s complexity extends to both Original Medicare and Medicare Advantage plans. Medicare Advantage plans often operate like standard insurance policies, each having specific limitations related to their network of providers. At times, an insurance provider for a Medicare Advantage plan might not cover specialist visits, even if the enrollee received a referral, resulting in the enrollee covering all related expenses out of pocket.

Following Donald Trump’s re-election for a second term, there are rising concerns regarding Medicare’s future. Predictions suggest that increased price transparency and a focus on Medicare Advantage plans may push towards the privatization of the program. For now, the most prudent action for current and prospective retirees is to keep an eye on their coverage choices and associated costs.

The U.S. healthcare landscape can be bewildering, but gaining a clear understanding of Medicare fundamentals and being mindful of possible changes can aid retirees in maneuvering through the program more successfully.