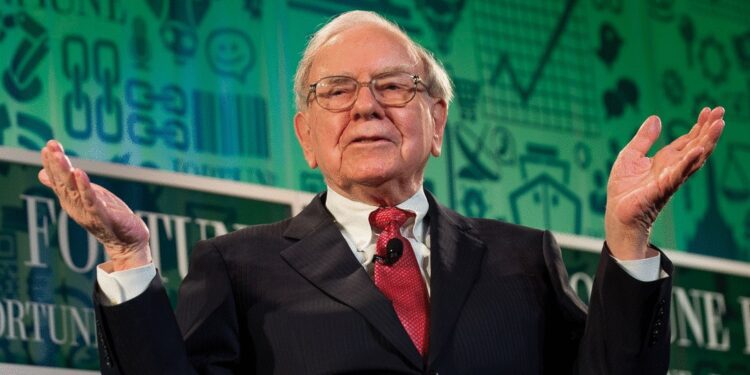

With recent investments, Warren Buffett’s Berkshire Hathaway has been making waves in the stock market. The company’s $388 billion portfolio contains 44 stocks; three stand out as screaming buys for the second half of 2024 and beyond. Amazon is one of the top picks.

Despite its relatively high valuation, the e-commerce giant’s fast growth and reinvestment strategy make it an attractive choice. Amazon Web Services, the company’s cloud infrastructure platform, has surpassed $100 billion in annualized run-rate sales and contributes significantly to the company’s operating income. Amazon is a compelling buy, with shares trading at about 13 times the estimated cash flow per share for 2025.

Chevron is another no-brainer Warren Buffett stock. The energy company’s diversified operations and strategic decisions have helped it navigate potential economic downturns. Chevron’s pending $53 billion acquisition of another major energy company is expected to enhance its operational footprint and drive growth.

Coca-Cola is also historically inexpensive, trading at less than 11 times forward-year earnings. Thus, Coca-Cola rounds out the list of Warren Buffett stocks that are screaming buys.

Buffett’s compelling investment choices

The beverage giant’s strong branding allows it to increase prices to offset rising expenses, and its products are considered basic necessities, ensuring steady consumer demand. Coca-Cola boasts over two dozen brands generating at least $1 billion in annual sales and operates in almost every global market. The company’s robust capital-return program, including a 62-year streak of dividend increases, further enhances its appeal.

Buffett has also been buying shares of his own company, Berkshire Hathaway, since 2018. The company’s share price has surged by more than 96% since the first repurchase under the new plan, outperforming the broader market. Buffett sees room for Berkshire Hathaway to continue outperforming the average American business over the long run, driven by its core operations and substantial cash reserves.

Other Warren Buffett stocks to consider buying now include Occidental Petroleum, Bristol-Myers Squibb, and Visa. Occidental Petroleum is benefiting from Buffett’s increased ownership stake and investments in a lower-carbon future. Bristol-Myers Squibb offers a high-yield dividend and is expected to recover strongly from recent patent expirations.

Visa, the world’s leading payment processor, is a compelling choice for long-term investors. Analysts give it a Strong Buy rating and a 14.4% upside potential. Overall, these Warren Buffett stocks offer compelling opportunities for investors looking to broaden their market exposure and benefit from the wisdom of one of the greatest investors of all time.