Namibia is one of the youngest countries in history. With its independence gained in 1990 by separating from South Africa, it is an enormous country of 824,300 square kilometers, 40% larger than the Iberian Peninsula. However, its size can be misleading, as it is actually a vast desert with a population comparable to that of Valencia (2.5 million inhabitants). Moreover, they only have access to a very small portion of South Africa’s resources, making it, in practice, a small economy. However, the EU’s ‘green transition’ and the cut-off of Russian gas have provided Namibia with an unexpected opportunity: without large reserves of oil in its land, or funds to invest in alternative sources, Namibia has a plan to become a true energy powerhouse and boost its economy.

Europe’s top dignitaries and leading companies in the sector have been meeting constantly with counterparts from this distant country since 2022. Ursula von der Leyen herself met with representatives of the country in October 2023 after signing a ‘strategic partnership agreement’ in 2022. During the meeting, the commission president explained that “thanks to its abundant renewable energy potential, Namibia is becoming a leader in the green hydrogen space. The EU is proud to be a partner on this transformative journey towards green industrialization. Together we can further decarbonize our economies, create jobs, and ensure a more prosperous and greener future for our societies”.

After losing Russian gas and due to its green transition plans, Europe has set green hydrogen as the cornerstone of its future energy project. Despite only 2% of the region’s energy coming from hydrogen currently (and only 5% of that being green), the EU aims for this to be its major supplier and has already initiated a total of 40 projects for the next decade. The REPowerEU plan sets a target of consuming 20 million tons of green hydrogen by 2030.

In this context, Europe has already invested 2.000 million euros in the last decade to boost this energy source, according to EIB data. These plans are accelerating this month, as the first European Hydrogen Bank subsidy auction was completed with the green light given to seven projects in Spain, Portugal, Finland, and Norway, receiving a total of 720 million euros. Europe’s goal is to produce 10 million tons of the total 20 million on the continent, but they want to secure the supply of the rest by investing in projects abroad in Egypt, Morocco, and Mauritania… with Namibia as the crown jewel.

The country has launched six enormous investment projects since 2021. Since then, Hage Geingob, the country’s president, stated this March that the plan to develop its hydrogen industry in the coming years amounts to 20.000 billion dollars. A figure that may seem entirely unthinkable for a country with a GDP of only 12.900 million dollars. However, this possibility gains strength after the concrete realization of a 10.000 billion project in the coastal city of Luderitz, developed and launched by the local company Hyphen Hydrogen.

Only in this project, which will be the flagship of their green offensive, the country expects to achieve an investment similar to its entire economy. The idea is for it to start running at full capacity by the end of the decade and produce 2 million tons of green ammonia annually. During its construction, it will provide employment for 15,000 people, and when operational, it will require 3,000 permanent employees.

But where does the money come from for a local company to spend practically its entire economy on a single plant and want to double that with five more? The answer is that a good portion of the funding comes from its former metropolis, Germany. The firm’s main shareholder is Enertrag, the German renewable energy promoter, and Hyphen is nothing more than a consortium between this German firm and the local infrastructure firm, Nicholas Holdings. The rest comes from funds.

Regarding this project, Namibia will acquire a 24% stake and has even more ambitious plans. With the help of McKinsey, they have developed a strategy that envisions three hydrogen production zones along the coast in a plan that includes mineral refining and renewable energy hardware manufacturing along with pilot programs for trains and public services powered by hydrogen.

Aside from this flagship project, known as Hyphen SCDI, five others are already underway, although not all are for production but rather investments to store and export production, becoming a true source of wealth for the African country.

Daures is one of the most recent examples. In March of this year, the government announced that it had completed its construction by 80% and that in July it would begin pumping energy. The idea is that it starts by supplying the local market with 3,500 tons of green ammonia production, but gradually increases its output to 700,000 in a final phase. This project was also financed with German capital. Although the exact investment amount is unknown until completion, the German government granted a $220 million grant to the Finnish company Enersense behind the project at this location in 2022.

The third ‘hydrogen valley’ as the local government knows it is the Puros project in the northern region of the country. The other projects consist of enormous ports for transporting hydrogen (and LNG, as they operate in a similar manner) to the world and particularly to Europe. They are also building infrastructure to store their production. Even without having produced yet, they are already signing agreements with neighboring countries for the supply of some companies.

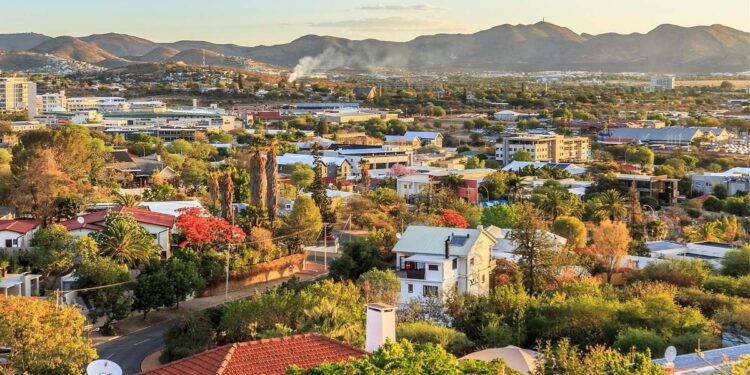

The reason why Europe has chosen this African country to become the major recipient of its million-dollar investment in green hydrogen is not a coincidence. The money from Brussels, Berlin, Paris, and Madrid has focused on Windhoek because the country, like no other, meets the conditions to create one of the largest ‘hydrogen’ empires in existence. Firstly, it is a country with 1,700 kilometers of coastline that, unlike almost all other nations, is practically uninhabited.

According to Hafeni Motsi, a senior energy investment analyst at the Namibia Investment Promotion and Development Board, this implies that it has many strategic natural areas for green hydrogen due to its sparse population, and in that sense, it is a perfect ground for both hydrogen production activities and synthetic fuel production. Finally, the young republic has found in being the second least populated country on the planet (after Mongolia) a strategic advantage.

FdIntelligence explains further that the process for green hydrogen production is through splitting water into hydrogen and oxygen, a mechanism put into practice through wind and solar energy. Namibia offers a unique combination in that sense: the World Economic Forum points out that it has nearly “10 hours of intense sunlight per day for over 300 days a year, one of the highest photovoltaic potentials in all of Africa.” It also “has high wind speeds” to further reduce the cost of wind energy.

“If these conditions of Namibia allow production at $1.5 per kg compared to a global average price of $4-6 per kg”

If combined with its vast uninhabited spaces, the country can be one of the most profitable in the world for this type of technology. According to estimates from the country’s Investment Promotion and Development Board, future projects can produce green hydrogen for $1.5 per kilogram. To understand how inexpensive Namibia’s entry would be, the latest data from the International Energy Agency puts the price of ‘green kilo’ globally between $4 and $6.

At the same time, Namibia presents itself as one of the leading countries in Africa to undertake large projects of this kind. In a continent with very unstable economies, stable surroundings are essential for a mega-investment like the one needed for green hydrogen. In that sense, Namibia has a B1 credit rating from Moody’s, which is the sixth highest in all of Africa.

“In Namibia, there is a strong legal system and financial stability”

In 2023, the country had already recovered its pre-covid economic figures riding on its humble oil and mining industry by growing 4.3% that year. Although the World Bank now expects a slowdown until 2024, the institution notes that “it is making significant progress in poverty reduction, cutting the number of people living below the threshold in half since 2009 and reducing this statistic to 17.5%”. A relatively calm situation for the region, something that the companies investing in these projects consider fundamental.

“Hydrogen is not like oil and gas. Only a few people have oil. In hydrogen, many have solar and wind energy. Therefore, in the case of hydrogen, the country’s risk profile plays a disproportionate role,” says Marco Raffinetti, CEO of Hyphen Hydrogen Energy. “In Namibia, there is a strong legal system and financial stability.”