Achieving financial wellness begins with recognizing how you manage your spending. However, without effective tools, documenting each expense can become quite laborious. This is where the Rocket Money application steps in. Previously branded as Truebill, this well-known financial management tool has assisted over 5 million users in enhancing their money management skills. Featuring an easy-to-use interface along with a visually appealing design, Rocket Money simplifies the process of overseeing your finances. Its comprehensive platform offers a variety of features such as credit score monitoring, management of subscriptions, budgeting tools, and much more.

Discover how Rocket Money empowers individuals to take charge of their financial health and achieve financial independence and how you can move forward to determine if this app suits your needs.

Overview of the Rocket Money App: Advantages and Disadvantages

The Rocket Money application comes packed with powerful features aimed at promoting financial wellness, making its popularity quite clear. Here’s a quick look at its advantages and disadvantages:

Advantages:

- User-friendly interface

- Compatible with iPhone and Android devices

- Links with all banking, credit card, and investment accounts

- Bill negotiation tool

- Subscription tracking and cancellation services

- Budget creation tools

- Free version available

- Security features (256-bit encryption, similar to what banks utilize)

Disadvantages:

- Limited functionalities in the free version

- Insufficient investment tracking features

- High fees for bill negotiation

Essential Features and Advantages of the Rocket Money App

According to a recent study by Self Financial, the average household in the U.S. wastes $32.84 monthly on unused subscriptions, which adds up to nearly $400 a year—a significant sum. Rocket Money assists users in reducing expenses associated with unused subscriptions and provides more through its innovative functionalities. Beyond robust subscription management, this app offers features such as bill negotiation, expense monitoring, budgeting strategies, financial health analysis, and automated savings goals.

Getting Started with the App

Prepared to dive in? The process is straightforward. After downloading the app, connect your bank accounts and credit cards securely via Plaid, which allows the app to analyze your spending. From that point, you can begin to take control of your finances and monitor your financial health. The app is accessible on a range of devices. You can find the Rocket Money app on Google Play or in the App Store.

Pricing Options

Rocket Money aims to assist users in achieving financial empowerment, offering a free version of the app. For those seeking more advanced budgeting features, a premium membership is available. Generally, premium users can expect to pay between $6 and $12 monthly, with prices varying slightly.

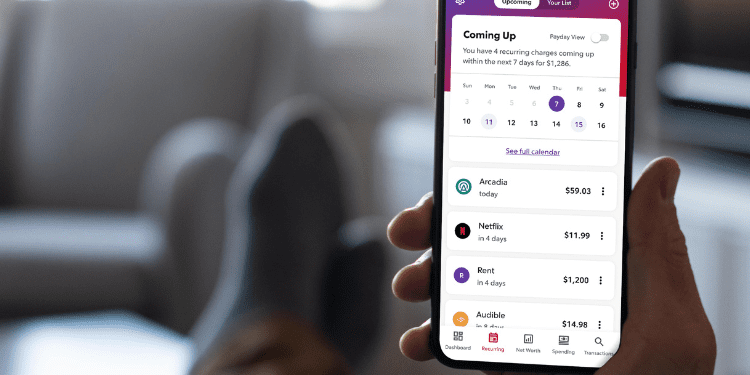

Managing Subscriptions

Rocket Money has successfully canceled approximately 2.5 million subscriptions for its users, helping them save money and declutter their financial commitments. The app sees recurring charges and makes users aware of any subscriptions they might have overlooked. Should you wish to cancel a subscription, the app provides a concierge service to manage the cancellation for you, saving you time. Additionally, Rocket Money keeps track of your upcoming bills, ensuring you can pay them on time to avoid late fees.

Negotiating Bills

Rocket Money’s bill negotiation tool helps you save on monthly expenses by obtaining better rates. Simply connect your bills, and the app’s experts will attempt to lower costs for services such as cell phone plans and auto insurance. If they are successful, you’ll pay a fee that’s between 35% to 60% of the savings from your first year, allowing you to choose your rate. Plus, should your bank charge you overdraft or late fees, Rocket Money can assist in getting those refunded, maintaining your financial health.

Tracking Expenses and Budgeting

Establishing a budget is often the foundational step towards financial stability, but keeping tabs on every grocery bill or online purchase can be time-consuming and stressful. Rocket Money alleviates this process by automatically monitoring and categorizing your expenses, helping you align your spending with your financial objectives. The app analyzes your transactions to determine your monthly spending limit, clarifying how much you can afford to spend. Moreover, you can create individualized trackers for specific categories. To help you avoid overspending, Rocket Money will notify you as you approach your set spending limits.

Monitoring Financial Health

Your financial health affects everything from managing unexpected expenses to preparing for retirement. For many, financial stability is an ongoing journey requiring regular assessment to stay on course. The Rocket Money app offers a thorough overview of your financial situation by monitoring your credit score and tracking your net worth. The app notifies you about significant changes that might affect your credit score and offers guidance on interpreting those changes. Additionally, Rocket Money enables you to manage all your assets and liabilities in one central place, including regular categories like a 401(k) plan, with the option to add personalized categories.

Automating Savings Goals

Whether you aspire to buy a home or simply want to save for unexpected expenses, Rocket Money makes saving straightforward. The app evaluates your accounts to identify optimal saving moments, helping you achieve your goals more rapidly while avoiding overdraft risks. You have the option to set a savings goal, select a preferred deposit frequency, and observe your savings grow. All deposits are kept securely with Rocket’s FDIC-insured banking partner, ensuring the safety of your funds. Furthermore, you retain full control over your savings—you can modify, pause, withdraw, or close your account at any time.

How Does Rocket Money Aid Your Self-Improvement Objectives?

If enhancing your financial landscape is part of your self-improvement path, the Rocket Money application is here to assist.

Boosting Financial Awareness

Mastering personal finance begins with self-awareness. However, research indicates that over 50% of Americans either don’t budget or aren’t aware of their monthly expenditures. This lack of insight can swiftly lead to overspending and escalating debt. The Rocket Money app enables users to monitor their spending habits and tendencies, nudging them toward making sound financial choices.

Encouraging Goal Achievement and Accountability

Studies have demonstrated that establishing financial objectives is pivotal for effectively saving money. Rocket Money supports your journey by enabling premium users to set financial targets within the app. To bolster accountability, it provides goal-tracking functionalities that let you oversee your progress, make necessary adjustments, and maintain motivation. You can remain accountable through community engagement, celebrate your financial successes, and efficiently meet your savings milestones.

Fostering Consistency in Money Management

One of the more challenging aspects of forming any habit, including improved spending and financial management habits, is maintaining dedication to your changes. The Rocket Money app aids you in preserving consistency and following through with your commitment to enhanced financial well-being and a more promising financial future.

Customer Reviews for Rocket Money

With an average rating of 4.4 out of 5 stars on Trustpilot, most users express satisfaction with their experience using Rocket Money. A number have praised the app for its wide array of financial management tools consolidated into one platform, with one user commenting that it’s “like having an accountant at your fingertips.” Others have found that it makes budgeting significantly simpler, enabling them to save more effectively than before. Feedback on Rocket Money’s customer support has been mixed, but users generally seem content with the assistance they received. Although the primary user group is adults in their twenties and thirties, the app can be beneficial for individuals of all ages.

Alternatives to Rocket Money

While Rocket Money is a well-regarded financial application for many users, numerous other financial management tools are available for personal and professional use. Alternatives such as Honeydue, Empower Personal Dashboard, and YNAB offer great functionalities that may differ from those available in Rocket Money. Experimenting with the top financial applications can assist you in determining which option aligns best with your needs.

Regain Control Over Your Finances

Financial wellness begins with organizing your money, and modern technology has made this simpler than ever. The Rocket Money app aids in your quest for financial independence by easing tracking of expenses and monitoring your savings objectives. Download the Rocket Money app today to explore its features and benefits firsthand. By taking control of your financial tracking and management, you are setting the stage for your journey toward financial self-improvement.

Frequently Asked Questions

Who is the Rocket Money App Designed For?

Rocket Money aims to assist individuals in gaining control over their personal finances. Although it’s suited for a broad audience, its primary demographic is U.S.-based users aged 23 to 34 and above.

What Distinguishes the Premium Membership?

Premium members of Rocket Money have access to a more extensive range of features compared to those using the free version. Premium functionalities comprise:

- Unlimited budget creation

- Comprehensive credit reports

- Cancellation support services

- Net worth monitoring

- Intelligent savings accounts

- Real-time synchronization

- Transaction oversight

- Account sharing capabilities

- Data export options

What Features Does the Free Membership Offer?

Although the free membership lacks many of the features available to premium members, some beneficial financial tools are still accessible. Free features include:

- Linking accounts

- Alerts for balance

- Subscription management tools

- Spending tracking functionalities