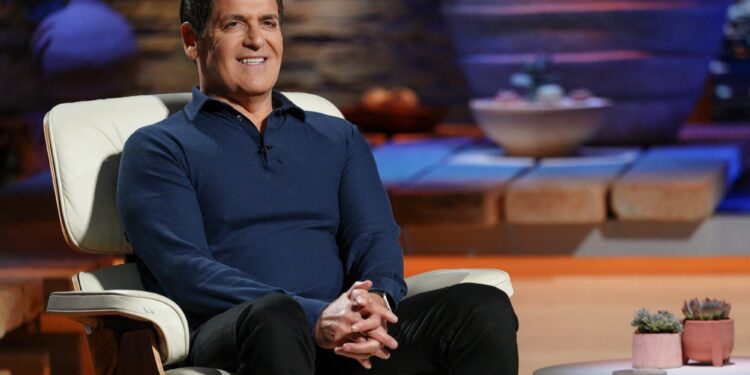

Since joining the ensemble of Shark Tank, Mark Cuban has made his financial resources available to those with innovative concepts and solid business strategies. He has allocated tens of millions of dollars to a multitude of companies that often appear unrelated. While some of these investments flourished, others fell short of Cuban’s expectations, yet each captivated him from the outset.

An examination of some of Cuban’s standout investments on Shark Tank may not reveal a consistent approach—his creative thinking ensures he remains unpredictable with his funds—but it offers insight into what constitutes a compelling idea to a man well-versed in a wide array of pitches.

Ten Thirty One Productions

Bringing the next big idea to life…

Melissa Carbone sought to entice Cuban and the other Sharks to invest in Ten Thirty One Productions, a venture that began with a haunted hayride in Los Angeles, by bringing along a zombie and a possessed scarecrow to her Shark Tank presentation.

However, Cuban was unfazed by the theatrics. He ultimately decided to make what was then the largest investment in the show’s history: $2 million for 20% equity. His primary motivation appeared to be growth; the success Ten Thirty One Productions found in Los Angeles had potential for replication in cities like San Francisco, Dallas, Miami, New York, and Nashville. There’s a demographic who relish being genuinely scared, and this is an experience that can’t easily be replicated. It requires a unique kind of terrifying encounter, and for good reason, Ten Thirty One Productions masterfully crafts such experiences for thrill-seekers. Cuban deemed it the “next big thing” and quickly convinced them to strategize an expansion into Dallas, where he resides.

UniKey Technologies

A go-getter turns ideas into action…

Entrepreneurs typically operate within their areas of expertise. In Cuban’s case, it’s technology or software poised to become mainstream. UniKey Technologies approached Shark Tank with a plan that featured a smartphone-operated electronic door locking system, effectively rendering traditional keys obsolete.

Despite his fondness for innovative tech, Cuban appreciates the need for resourcefulness and follow-through. He wore a knowing grin as he labeled the company’s founder, Phil Dumas, a hustler. Dumas embraced this title, declaring he was previously the VP of MIH (Making It Happen). In the end, he secured Cuban a position on the company’s board.

CoolWraps

Having a great idea in your corner…

Cuban was keen to learn the origins of CoolWraps when Jeffery Miller pitched it on Shark Tank. The concept seemed promising—a customizable gift bag that, once filled, can be shrunk with a hairdryer to perfectly fit the gift inside. So why had Miller invented this product a decade ago without any sales?

The reality was that Miller lacked sales expertise. He struggled to attract investors and obtain bank loans. Nevertheless, he held a significant asset: a utility patent that barred others from utilizing his concept. Consequently, Cuban recognized the potential and seized the opportunity to invest in an idea that carved out its own unique market. His choice underscored a valuable lesson: while business acumen and salesmanship are critical, a distinctive idea is a solid foundation.

DUDE Products

Smart strategies post-investment…

Cuban isn’t solely attracted to the flashiest products. He invested in DUDE Products due to the founders’ vision of rebranding flushable baby wipes tailored for men. The founders, longtime friends from college, were recent graduates brainstorming in their small apartment, which likely resonated with Cuban, who first made a name for himself during similar formative years. This connection led to his investment in the company.

He recently commended DUDE Products for their decision to enhance advertising efforts during the early quarantine phase while other companies opted for retreat. Amid a backdrop where toilet paper became a scarce commodity, DUDE Products effectively expanded their outreach to a wider audience.

The Red Dress Boutique

No desire for excessive guidance…

One effective strategy for luring investment is showcasing independence. The Red Dress Boutique had already generated millions when Diana Harbor and her spouse Josh pitched their online retail business on Shark Tank. “I think the main factor is that [Cuban] recognized we were an established company,” Josh explained to CNBC. “We weren’t starting from scratch.”

The business wasn’t perfected, but Cuban’s investment indicated that he preferred to invest in something substantially along the path rather than just an idea. “We didn’t require someone to guide us through every step, but we were definitely looking for his counsel. We sought a partner who could provide insight during our significant upcoming growth phase.”

Melni Connectors

Understanding Cuban’s vision…

When the founders of Melni Connectors claimed their firm was worth $10 million, Cuban described them as “delusional.” Their product was quite niche; a faster, safer, and more affordable connection technology for electrical systems. Average consumers might struggle to grasp its practical advantages, a feeling that resonated with many of the Sharks.

Yet, Cuban noted that during his early entrepreneurial days in the burgeoning internet landscape, similar skepticism surrounded his ideas. What mattered most was their comprehension of how their innovation could simplify industry operations. This realization led him to invest $500,000 in the venture.

iLumi

Proving investor value…

iLumi specializes in color-tunable LED smart bulbs that can be controlled and change hues via smartphones. They can also integrate with smart speakers and function as alarms or regular multimedia devices that synchronize with the room’s colors. Cuban recognized his value in championing their growth. “The real potential for this company lies in continuous innovation,” he mentioned on Shark Tank.

A true negotiator at heart, he sought more than the initial 15% stake offered; he pressed for 25% in exchange for his $350,000 infusion. iLumi needed to ascertain how his involvement could be advantageous to them. They queried him about the contacts he had that could revolutionize their prospects. His reply? “Everyone will answer my call.” That was all they needed to hear, and thus, a deal was finalized.