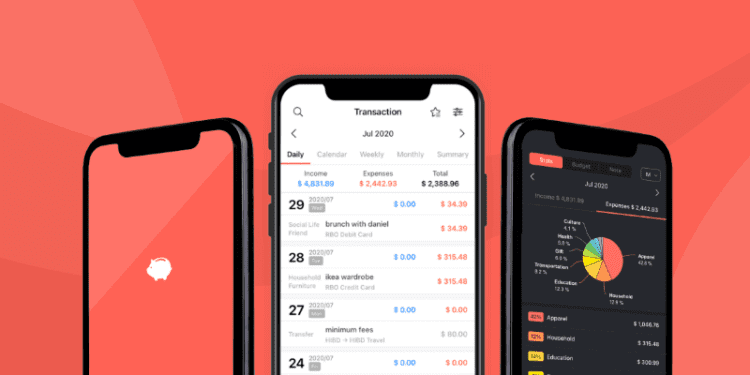

With more than 20 million downloads, Money Manager has simplified budgeting for everyone. What has led to its rise as a top contender against Mint alternatives? The Money Manager app offers straightforward access to weekly and monthly budgets, alongside a visually appealing interface that makes managing and assessing budgets an effortless task.

In this review of Money Manager, we’ll delve into its essential features for personal budgeting. You’ll discover its primary benefits and identify who stands to gain the most from utilizing it.

Key Takeaways

- Money Manager is a top personal budgeting app in 2024.

- It features intuitive visuals that can be customized for different parts of your budget.

- It’s particularly advantageous for young professionals, families, and business owners.

Money Manager App Pros And Cons

Money Manager is ideal for individuals seeking comprehensive budgeting. It generates thorough financial reports and supports multiple currencies. Beyond providing detailed lists, it presents broader data through charts that depict asset fluctuations. Nonetheless, despite its user-friendly design and excellent user feedback, this app does have some shortcomings.

Pros

- Encourages accountability for poor financial habits

- Budgeting is categorized and viewed as a total budget

- Graphs and visuals are straightforward and easy to understand

- An engaging, real-time interface makes budgeting captivating

Cons

- Limited to personal, family, or small-business budgeting

- Not a free application

What Are The Key Features Of Money Manager?

The Money Manager app provides a cohesive budgeting experience thanks to its comprehensive approach. Its extensive feature set distinguishes it as one of the premier financial management tools for 2024. Money Manager also delivers “quick glance” assessments of spending for each month or week.

Let’s explore its main features in greater detail to gain additional insights.

Expense Tracking

Money Manager generates a “slide” for every expense. The photo uploading feature allows users to save receipts along with memories, creating meticulous records. It effectively captures both the “what” and “when” of expenditures, and offers color-coded categories to categorize spending.

Budget Planning

The Money Manager app permits users to assign monthly budgets to every category. Each category shows the percentage spent as well as the remaining balance. Categories that exceed their budget are indicated in red, while those under budget appear in blue. Additionally, there is a reinforced filter for evaluating income against expenses.

Debt Management

Money Manager accounts for liabilities when setting up budgets. Users can manage credit card debt, loans, and other obligations within their total budget. Both the full remaining balances and current owed amounts are documented.

Investment Tracking

Money Manager gives users a platform to handle investments, real estate, and savings. Observing the growth of these assets relative to spending can serve as motivation. It can also present a realistic perspective regarding expenditures, especially if spending graphs overshadow the growth exhibited in investment and asset categories.

What Are The Benefits Of Using Money Manager?

Essentially, Money Manager acts as a personal aggregator of one’s weekly and monthly spending practices. It eliminates confusion by documenting and synthesizing spending patterns and budgets. By understanding where their finances go, users can adjust their habits to adhere to their budget.

Enhanced Financial Awareness

The most significant advantage Money Manager provides is a platform for uploading spending habits. Small purchases can accumulate quickly. Establishing a routine of uploading receipts can dramatically change the mindset of users who struggle with managing their finances.

Money Manager offers users a comprehensive look at their financial situation. With continued usage, spending trends can emerge. This understanding is crucial for making informed financial choices aligned with long-term objectives.

Focused Goal Achievement

Money Manager encourages users to act upon their objectives. By generating reports that juxtapose spending with income, it nurtures a goal-driven perspective. As users modify their spending patterns, they can observe their graphs starting to align with their aspirations, creating a rewarding experience that boosts confidence and positive behaviors.

Reduction of Stress And Promotion of Mental Wellness

A notable connection exists between financial stress and mental health issues. Many individuals have felt this impact personally. While Money Manager may not resolve financial challenges overnight, it can assist users in establishing healthy financial habits.

Studies indicate that half of U.S. adults lack financial literacy. Money Manager aids users by providing easily understandable visuals to grasp their financial situation. Its user-friendly functionality makes it feasible for nearly anyone to gain control over their budgeting.

Empowerment And Self-Assurance

Money Manager translates the information users input into actionable insights. There’s no need for advanced math skills or accounting knowledge to make the most of this app. Its approachable features empower individuals to take charge of their financial lives, leading to increased confidence and a sense of independence.

The Money Manager app clearly shows users their position regarding income versus monthly expenses. If a purchasing decision arises, they can consult the app’s income-versus-expenses feature to determine how close they are to fulfilling their budgeting goals.

Who Stands to Gain the Most from Money Manager?

Money Manager provides the necessary metrics for anyone’s personal, household, and business budgeting needs. Although anyone can utilize the app, specific demographics are more likely to reap greater benefits. This typically includes young professionals, families, business owners, and individuals aiming for financial well-being.

Young professionals navigating new careers and living independently greatly benefit from this app’s features. Convenient tracking and uploads enable them to develop spending accountability. For families, pinpointing specific expenditure areas is critical for establishing an effective household budget.

Lastly, integrating asset and investment tracking proves especially beneficial for business owners. It enables them to conduct both weekly and monthly evaluations rather than focusing solely on their expenditures.

Final Insights On Money Manager

The Money Manager app is an all-encompassing budgeting tool with an intuitive interface that is simple to navigate. It stands out as one of the top options for logging real-time spending, allowing for the creation of longer-term trends. The app excels at offering users the ability to zoom in and out to understand both “macro” and “micro” spending factors.

While Money Manager cannot substitute for responsible financial habits, it can support them. This application aids users in making smart financial decisions “in the moment” while also taking long-term goals and income realities into consideration. Think about downloading Money Manager today to initiate your journey towards a brighter financial future.