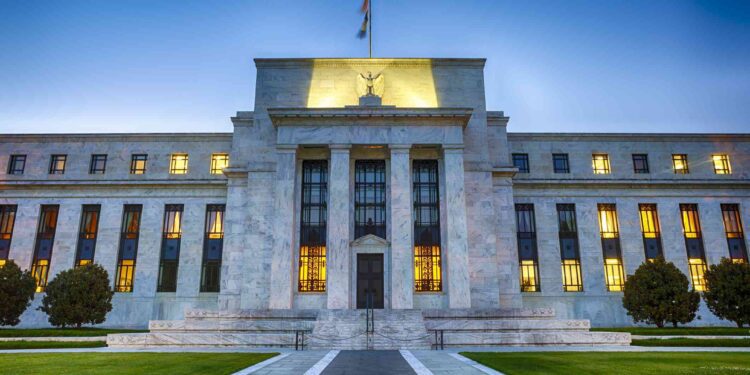

The impact of the Federal Reserve’s decision to extend periods of low interest rates on the global economy is significant. This policy is aimed at stimulating economic activity and combating inflation, but it also presents several challenges. For example, savers are discouraged by the minimal returns on their deposits.

However, this approach can also create instability due to increased speculative activities, as investors gravitate towards riskier assets. Lower borrowing costs could lead to excessive borrowing, potentially triggering an economic downturn.

The effects of these decisions are particularly pronounced in countries that rely on foreign investments, such as Japan. With sustained low interest rates in the US, substantial funds may flow into the American market, leading to economic imbalances. The value of the Yen has been fluctuating, causing uncertainty in Japan’s financial market.

Adding to Japan’s economic challenges are the effects of a shifting global trade environment, including recent tariff increases imposed by the US and a notable decline in sales to China, one of its major markets. Despite these obstacles, the Japanese government is implementing strategies to stabilize the economy and restore investor confidence.

This period poses a challenging path for Japan’s economic recovery, especially as the nation contends with internal issues such as an aging population, decreasing birth rates, and a shrinking workforce.

Global Impact of the Federal Reserve’s Low-Interest Policy

These challenges extend beyond domestic concerns to international monetary decisions, testing the economy’s resilience.

Despite the economic turmoil, experts remain cautiously optimistic. The innovative technology sector in Japan and its robust export industry could potentially steer the country out of this turbulent phase. Ultimately, how effectively Japan navigates through these complexities will determine its economic resilience and adaptability.

Given these global shifts, the Japanese economic sector is under pressure to implement robust strategies to cushion and mitigate potential consequences. This includes fostering partnerships with international financial entities.

The Federal Reserve’s significant policy shift is concerning for economies like Japan, as it signals a potential rise in inflation that could weaken the Yen and increase domestic prices. Nevertheless, Japan is exploring measures such as reducing public debt, enacting structural reforms, and enhancing productivity as safeguards against inflation.

As businesses navigate the constraints of the pandemic and evolving regulatory landscapes, they must remain vigilant and adaptable. The broader economic ramifications of these policy adjustments could lead to prolonged instability. Therefore, a business’s resilience and flexibility will be crucial to its success in the post-pandemic era.