Personal finance authority Dave Ramsey cautions the American public regarding the increasing challenges linked to Social Security and Medicare. He asserts that depending solely on these programs for retirement income is insufficient. The typical monthly payment from Social Security falls below $2,000.

This implies that individuals must seek additional avenues for saving and investing, such as 401(k) accounts and IRAs, in order to enjoy a comfortable retirement. Although Medicare assists with healthcare expenses, it does not encompass all costs. Retirees are still responsible for deductibles, copayments, and long-term care expenses.

Ramsey recommends acquiring long-term care insurance before reaching the age of 60 and establishing a Health Savings Account (HSA) to set aside funds for medical costs. He also describes Social Security as a “mathematical disaster.” Nevertheless, he often advises that it may be more advantageous to begin drawing benefits at age 62 instead of delaying until the full retirement age.

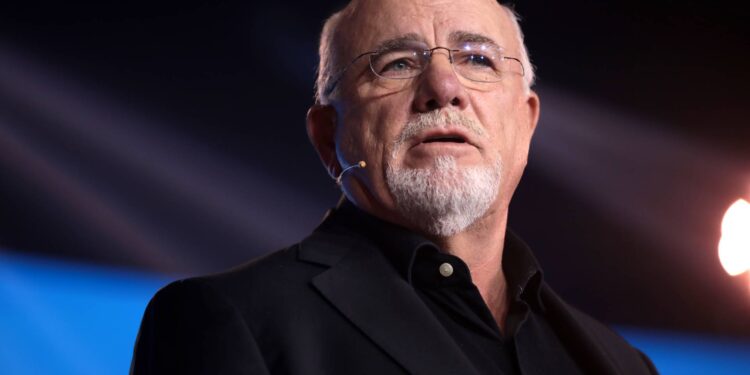

Dave Ramsey raises concerns about retirement preparedness

The rationale is that if you invest the Social Security funds received early, they can appreciate over time, possibly yielding greater financial returns eventually. For instance, Ramsey states that investing $700 each month from ages 62 to 77 could result in more than $318,000 accumulated. This could potentially be more beneficial than postponing for larger payments in the future.

Nonetheless, this approach carries risks and may not be feasible for everyone. Numerous retirees require their Social Security benefits immediately to cover essential expenses. Most professionals advise postponing benefit claims if a long lifespan is anticipated, as this will secure higher monthly payouts.

Ultimately, the choice of when to begin receiving Social Security benefits is a personal decision influenced by individual circumstances. Ramsey’s recommendations are designed for those with alternative income streams who can afford to invest their benefits. For many others, it may be wiser to wait and secure a more dependable income during retirement.