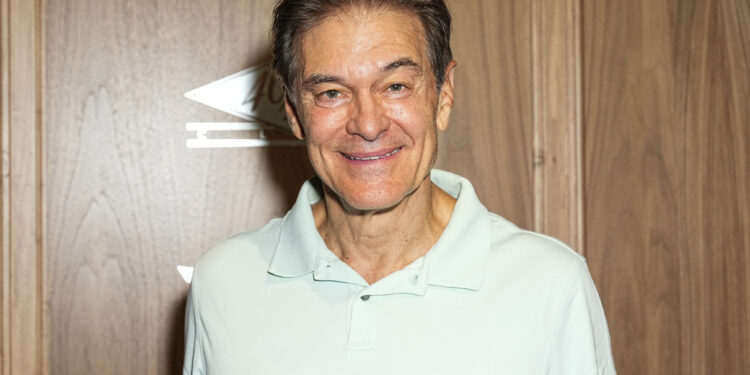

Dr. Mehmet Oz may possess millions in investments tied to firms overseen by the federal agency that Donald Trump has chosen him to head.

According to the Los Angeles Times, during his unsuccessful Senate campaign in 2022, the former talk show personality disclosed substantial investments in healthcare, medical technology, and food-related businesses, totaling tens of millions of dollars.

Recently, he received a nomination from the president-elect to lead the Centers for Medicare and Medicaid Services (CMS), a large agency responsible for providing healthcare coverage to over 160 million Americans while enforcing federal regulations for healthcare providers and suppliers.

When the Times inquired whether his investment status had altered since 2022—or whether he was open to divesting to prevent a potential conflict of interest—he declined to respond.

This poses an issue because if Oz is confirmed while maintaining these investments, it could be unclear if his decisions would be made in the best interest of Medicare and Medicaid beneficiaries or if they would reflect the interests of his investment portfolio, critics informed the Times.

For instance, Medicare has received congressional consent to negotiate pricing directly with the manufacturers of 10 specific medications. It is possible that Oz holds shares in the companies responsible for four of these drugs.

His portfolio may also contain a $600,000 investment in UnitedHealth Group, a significant player among CMS providers via its Medicare Advantage program. The company has faced allegations of excessive billing to the government, as reported by the Times.

A former cardiac surgeon, Oz frequently appeared as a medical commentator on The Oprah Winfrey Show before starting his own talk show, which he hosted from 2009 to 2022. He invested a significant portion of his wealth in health-focused enterprises, encompassing fertility clinics, hospitals, food corporations, agricultural operations, and supplements that he advertised on his program.

He has also indirectly poured funds into biotech and vaccine companies through venture-capital investments, and as of 2022, he and his family reportedly had a $2.4 million stake in Amazon, which runs an online pharmacy and primary care service accessible to Medicare beneficiaries, according to the Times.