In the world of entrepreneurship, financial hurdles can often appear overwhelming. A 37-year-old entrepreneur recently found himself facing potential bankruptcy, with about $120,000 in outstanding debt. This dire situation arose despite his earlier successes in reducing debt and his solid understanding of financial management strategies.

Debt Analysis

The individual’s debt comprises two primary elements:

- About $100,000 in credit card debt

- $20,000 in an SBA loan from a past business that faced hardships during the COVID-19 crisis

This considerable financial burden has pushed the entrepreneur to contemplate bankruptcy, weighing the option of stepping back from his current business in favor of conventional employment.

Even with the reduced income, the business is still turning a profit, averaging between $3,000 and $4,000 monthly. This modest profitability indicates that the business model has potential but needs to be refined and expanded to tackle the owner’s financial issues.

Reasons for Revenue Decline

A number of factors contributed to the sharp drop in income:

- Partnership Breakdown: The entrepreneur had to buy out his business partner due to personal challenges, which led to the mounting credit card debt.

- Inflation Impact: Rising costs across various sectors affected the company’s bottom line.

- Lead Acquisition Costs: The expense of obtaining leads from a lead generation firm rose sharply, forcing the owner to discontinue this marketing venture.

- Operational Struggles: The owner is currently managing all aspects of the business solo, which has resulted in diminished efficiency.

The Fundamental Issue: Income Generation

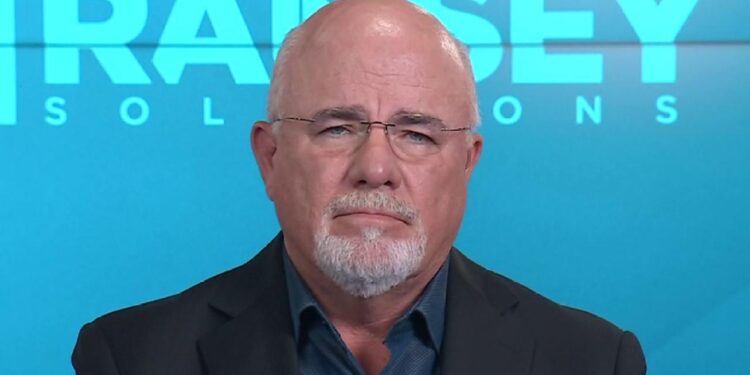

Financial advisor Dave Ramsey, celebrated for his strategies in debt management, assessed the situation and pinpointed the primary problem: inadequate income. Ramsey noted that the issue isn’t the debt per se, but the lack of sufficient income to counter it.

He remarked, “When you achieve an income, you’ve found your way out of this. Until you have that income, you don’t have a viable exit.”

Possible Solutions

Ramsey proposed several actionable strategies:

- Business Closure: If the current enterprise proves unfeasible, shutting it down and pursuing a conventional job might be the best option.

- Side Ventures: Continuing the business while exploring extra jobs could enhance overall earnings.

- High-earning Employment: Landing a lucrative job could swiftly facilitate debt repayment. Ramsey provided an example of a $200,000 salary to illustrate how quickly debt could vanish with ample income.

The Significance of Business Management

Ramsey made a pivotal observation that the entrepreneur seemed to be controlled by the business instead of the other way around. This lack of control is a common trap for many small business owners, which can exacerbate financial troubles if left unaddressed.

Sound business management entails:

- Strategic planning and objective setting

- Optimal allocation of resources

- Ongoing market evaluation and adaptation

- Effective financial oversight and budgeting

By reclaiming control over business operations and concentrating on income generation, the entrepreneur could potentially reverse his financial plight without opting for bankruptcy.

Key Takeaways for Entrepreneurs

This case study imparts several important lessons for both current and prospective entrepreneurs:

- Steer Clear of Personal Credit for Business Expenses: Utilizing personal credit cards to finance a business can pose severe financial risks.

- Be Ready to Adapt: In response to rising costs or shifting market dynamics, businesses must remain agile.

- Concentrate on Revenue Generation: In financial crises, boosting income should be the central concern.

- Preserve Control: Entrepreneurs should aim to steer their businesses instead of allowing their companies to dictate terms.

- Explore Diverse Income Sources: Multiple income streams can offer necessary financial security in challenging periods.

Though the entrepreneur’s circumstances may appear bleak, it is essential to recognize that bankruptcy isn’t the sole path forward. By honing in on income generation and examining alternative approaches, it is feasible to conquer even sizable debts and attain financial stability.

The way ahead may demand challenging choices and diligence, but with resolve and a focused effort on augmenting income, financial recovery is attainable. Whether by revitalizing the existing business, pursuing new job prospects, or a combination of tactics, the secret lies in taking charge of the financial scenario and proactively seeking solutions.

Common Questions

Q: Is filing for bankruptcy the only option for entrepreneurs burdened with significant debt?

No, bankruptcy is far from the only route. As demonstrated in this narrative, intensifying income through various channels, including enhancing business performance, pursuing additional jobs, or looking into new business ventures can provide viable alternatives to bankruptcy.

Q: How can entrepreneurs steer clear of substantial personal debt when financing their enterprises?

Entrepreneurs should seek funding alternatives like business loans, investors, or self-funding rather than defaulting to personal credit cards. It’s vital to maintain a clear separation between personal and business finances to reduce personal financial exposure.

Q: What actions can a business owner take when faced with rising operational expenses?

In light of increasing operational costs, business owners should investigate strategies such as adjusting prices, streamlining operations to cut expenses, finding new marketing routes, or adjusting their business model to uphold profitability.

Q: How crucial is adaptability in managing a successful business?

Adaptability is essential for business success. As illustrated in this case, market conditions can shift swiftly, affecting lead costs and overall profitability. Successful entrepreneurs need to be willing to modify their strategies, seek out new opportunities, and pivot when needed to preserve business viability.