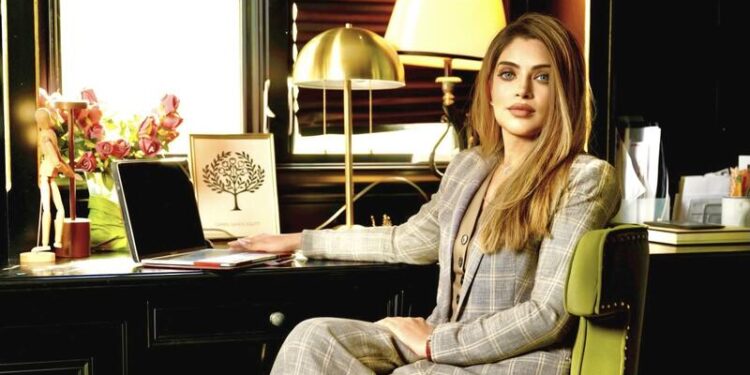

If you are interested in what the future may look like for humanity and how strategic investments can pave the way, consider engaging in a discussion with Reema Khan.

Khan is the pioneering founder and CEO of Green Sands Equity, a specialized venture capital firm centered on investing in fields such as technology, healthcare, space, and frontier technologies. Frontier technologies encompass various subfields, including quantum computing, brain-computer integration, and nuclear fusion.

It’s a thrilling realm, one that Khan fully recognizes. “There are concepts and technologies that do not exist today, but when they manifest, they can lead to transformative changes,” she shares. “We aim to allocate a portion of our portfolio to a potential future. It’s a significant gamble we take with these deep tech enterprises.”

Advocating for tomorrow

However, Khan emphasizes that technology is merely one aspect of the larger picture. “No technology or innovation can address global challenges or enhance the world unless there is a cultural readiness to embrace it.”

This is precisely why she commits her time and resources to advocacy and philanthropy, particularly focusing on empowering women and underrepresented groups. Furthermore, she serves as a trustee of the SETI Institute and chairs their Endowment Committee.

The SETI Institute is a scientific body, partially supported by NASA grants, dedicated to exploring the universe’s nature and the likelihood of extraterrestrial life. Khan financially supports the SETI Forward Award for the Carl Sagan Research Center, an accolade intended for undergraduate students pursuing careers in astrophysics, astrobiology, and astronomy.

“My guiding principle is that progress is marked by an increase in knowledge. Our goal is not merely to make the world more convenient but to uncover new truths and innovative ways to view and tackle issues,” she explains. “I often mention that progress is found not in improving what exists today, but in striving toward what is yet to come.”

Green Sands Equity also focuses on political and policy strategies designed to assist nations in creating incentives and frameworks to draw foreign investments. The firm operates out of Silicon Valley, with additional offices in New York, Europe, the Middle East, and Asia. This global perspective, according to Khan, fosters an ingrained “humility” that enables a multifaceted approach to issues while maintaining a “constant curiosity.”

Born in Saudi Arabia and raised in both Europe and the United States, Khan expresses, “At Green Sands, we often say we embody the spirit of an entrepreneur, a scientist, and a diplomat. We are all free thinkers who care about the world and possess a truly global outlook.”

In this context, Khan offers her insights regarding the mission of Green Sands and her perspective on private equity’s impact on the future.

Practical innovation

Green Sands Equity’s primary investment focuses are technology and healthcare. “Although the current buzzword is ‘AI,’ we prefer to speak in terms of ‘data,’” Khan points out. “We concentrate on hardware and software with an emphasis on enterprise rather than direct consumer sales.”

While this approach may be somewhat atypical for Silicon Valley, she suggests it’s influenced by their team composition, which includes scientists and engineers. “We favor hardware because, given the substantial amount of data we’ve amassed and the necessity for speedy processing to derive meaningful results—be it in AI applications or others—upgrading our hardware becomes essential.”

In the healthcare sector, Khan particularly highlights advancements in therapeutics and digital health. “These companies are indeed creating solutions that have never existed before. We’re striving to craft a future that isn’t here yet. Many are attempting to enhance what already exists, but we are fundamentally developing innovations that have never been done before, and that is incredibly exhilarating.”

One of the companies in Green Sands’ portfolio is SandboxAQ, which has recently acquired Good Chemistry, a firm specializing in computational chemistry, quantum computing, and simulation capabilities. Khan points out its significance in the pharmaceutical domain for drug discovery.

Another notable investment is Colossal, a company dedicated to “de-extinction.” Khan emphasizes its breakthroughs in artificial gestation and embryo studies. She notes that “this has beneficial implications for humans and genomics and will have a far-reaching impact beyond just reviving the woolly mammoth.”

Additionally, they have invested in brain-computer interface enterprises Synchron and Paradromics. Khan likens them to Elon Musk’s Neuralink but emphasizes that they are valued with greater agility. She labels them as “very impactful companies” that present “great promise” for individuals with disabilities, among other potential uses.

Facilitating change through investments

Khan highlights that several “flagship companies” in Green Sands’ portfolio are founded or led by women, including BioAge (co-founded by Kristen Fortney), Space Perspective (co-founded by Jane Poynter), Encoded Therapeutics (co-founded by Stephanie Tagliatela), Stepful (co-founded by Tressia Hobeika), Elve (founded by Diana Gamzina), and SpaceX (co-managed by COO Gwynne Shotwell).

“I do not select companies solely because they are women-led, but naturally, I scrutinize them more thoroughly before deciding against investment. I want to ensure that I do not overlook anything that holds worth,” Khan articulates.

“We need a greater number of women in investment roles since they are indeed the facilitators of thought and execution today,” she adds. “Placing women in these positions allows for meaningful change.”

Funding promising concepts

While Khan is making investments with an eye toward the future, she emphasizes that the firm adopts a “very pragmatic” philosophy that balances both short-term returns spanning three to five years and long-term commitments.

“We are accountable for generating returns. We manage the hard-earned funds of endowments and institutions engaged in significant work. Our primary responsibility is wealth creation for them as well.”

The prevailing wisdom often encourages investors to seek one or two substantial winners. From her perspective as a woman, she asserts, “you become adept at navigating a highly competitive market from the periphery, recognizing opportunities that others may overlook while still discerning their value.”

“We have successfully invested in numerous ideas and firms that may not be the next billion-dollar IPOs, yet they have developed products and tools that have catalyzed innovations for future enterprises,” Khan points out. Such companies often find themselves acquired by larger entities.

“Although these may not shine as the central stars, they are instrumental in establishing the groundwork for greater innovations to emerge,” she concludes. “These organizations are paving the way for further advancements.”

Green is a freelance author based between the United States and Spain.